If you didn’t get in on the housing market when interest rates were low, you may feel like you missed the boat.

The average rate on a 30-year fixed-rate mortgage is currently at about 6.7%. That’s down from 7.8% in late October, but way up from the 3% or so we saw in 2021.

For the casual observer, the culprit behind the climb is obvious. Starting in early 2022, the Federal Reserve began to hike its benchmark interest rate, which caused the rates on all sorts of debt to climb.

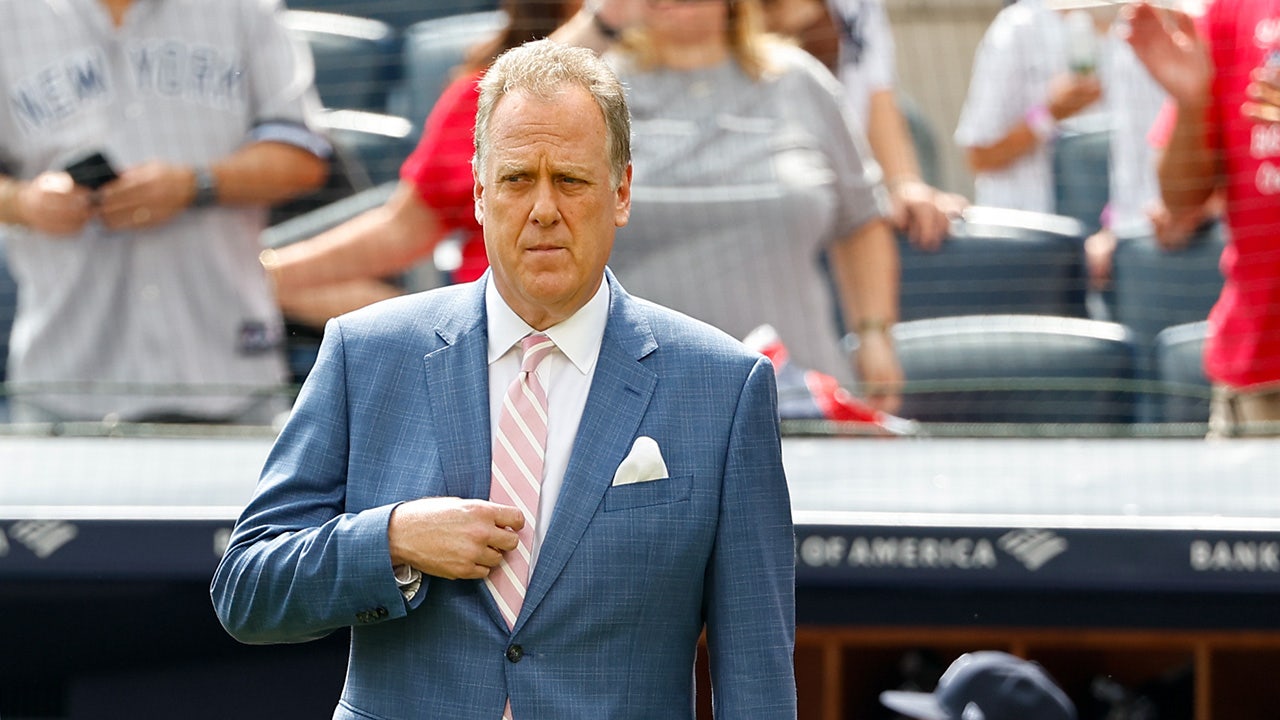

Orphe Divounguy, a senior economist at Zillow, would beg to differ. At a Zillow-sponsored event in October, he said that the Fed’s sway on mortgage rates was overstated. His thesis: “Don’t blame the Fed.”

If not the central bank, though, who?

Make It caught up with Divounguy in the new year to chat about the economic drivers of mortgage rates, where he thinks rates are headed in 2024 and whether or not it’s worth considering getting a mortgage with an adjustable rate.

CNBC Make It: The Fed sets short-term interest rates. Do mortgages tend to follow along?

Divounguy: Mortgage rates tend to follow the 10-year Treasury yield. We also know that very often there’s a spread between mortgage rates and the yield on the 10-year. Most of that spread is due to uncertainty about a number of factors in the market.

When it comes to the yield on the 10-year Treasury, which is kind of like the main driver of changes that we see, that depends on current inflation and economic growth, but also expectations over future inflation and future economic growth.

What has the picture looked like recently?

Inflation came down in the past year from almost 9% year-over-year to about 3%. We’ve seen some cooling of the labor market. We’ve seen a normalization in rent growth and price growth in the housing market. We’ve seen wage growth cooling. All of that tells me the U.S. economy is cooling.

As a result, yields have come down since October. In December, the Fed released its summary of economic projections, suggesting that it sees the U.S. economy cooling further in 2024. The market responded and you saw yield fall. So mortgage rates fell in anticipation of this cooling of economic activity in 2024.

Wait, so the Fed is involved.

Mortgage rates don’t really depend on the Fed. They depend on inflation, expectations over future inflation and economic growth.

There’s only so much the Fed can do to influence where mortgage rates end up. In fact, historically, when the Fed policy rate changes, it’s the short-term yields that move along with the policy rates. Long-term yields do not necessarily respond to the increase in the policy rate.

So long-term yields, such as Treasurys, move down when the market anticipates a weak economy and low inflation? Is that how it works?

Right — in advance of economic conditions. If you are expecting the U.S. economy to fall into a deep recession, then you might actually go out and buy bonds. You might go out and buy these long-term Treasurys.

That pushes the price of Treasurys higher [and pushes yields lower] because there’s an inverted relationship between bond prices and yields.

So who was to blame when rates were going up?

A strong economy. It’s consumers buying and businesses hiring. It’s a strong and resilient economy that boosted inflation to a 40-year high.

And as a result, we saw yields increase and you saw the Fed respond to the inflation surge by raising interest rates. We saw an increase in interest rates across the board. So a strong economy is essentially at fault.

So if we expect the economy and inflation to cool from here and the Fed to cut rates, should we expect mortgages to fall?

Like I said earlier, mortgage rates don’t necessarily respond one-to-one with the Fed policy rate. So a decrease in the Fed policy rate may not cause mortgage rates to decrease that much further.

It’s only if the U.S. economy is in a lot of trouble, and that investors believe that the economy could go into an economic downturn or contraction that we would see yields decrease further from the current level, and that we could see mortgage rates fall further. But those big mortgage rates, these drops rarely occur.

The yield on the 10-year Treasury typically falls about [1 percentage point] between the last rate hike and the first rate cut. That’s already happened. So my outlook is that it’s very unlikely that long-dated yields like the 10-year Treasury (that mortgage rates tend to follow) will fall much further from where they are right now.

OK, if we don’t think rates will fall much further this year, what about actual home prices?

New construction is still doing really well, especially in the single-family sector. I expect to see all those homes that are under construction coming on the market. That’s going to help put downward pressure on prices.

At the same time, if the cost of financing new projects goes down, then it’s likely we’re going to see new construction pick up the pace again a little bit, especially if they believe housing demand will be pretty steady in the coming year. That’s going to put some downward pressure on prices.

I expect prices to continue to increase, but basically increase at a slower pace than we’ve seen in the past few years.

Let’s say I have the money for a house, and I expect mortgage rates to come down eventually, if not much this year. Is it worth it to get an adjustable-rate mortgage?

I would say, don’t take the risk. If you can afford to buy now, it’s always better to get in the game. Your price growth is still positive, and that means you’re probably going to accumulate some home equity.

But if mortgage rates do fall, potentially, it would be because economic activity is struggling in a way that we’re having some serious economic troubles. And if you don’t lose your job, you could always have the option of refinance, which is what everybody did during the pandemic.

So that’s my advice for potential homebuyers. I think the optimal move here is to hedge against the risk that mortgage rates could come back up by getting in the game, if you can afford it now.

This interview has been edited for length and clarity.

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Want to land your dream job in 2024? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay. Get started today and save 50% with discount code EARLYBIRD.

CHECK OUT: ‘Loud budgeting’ is mentally and financially ‘healthy,’ says expert—and it’s good etiquette too