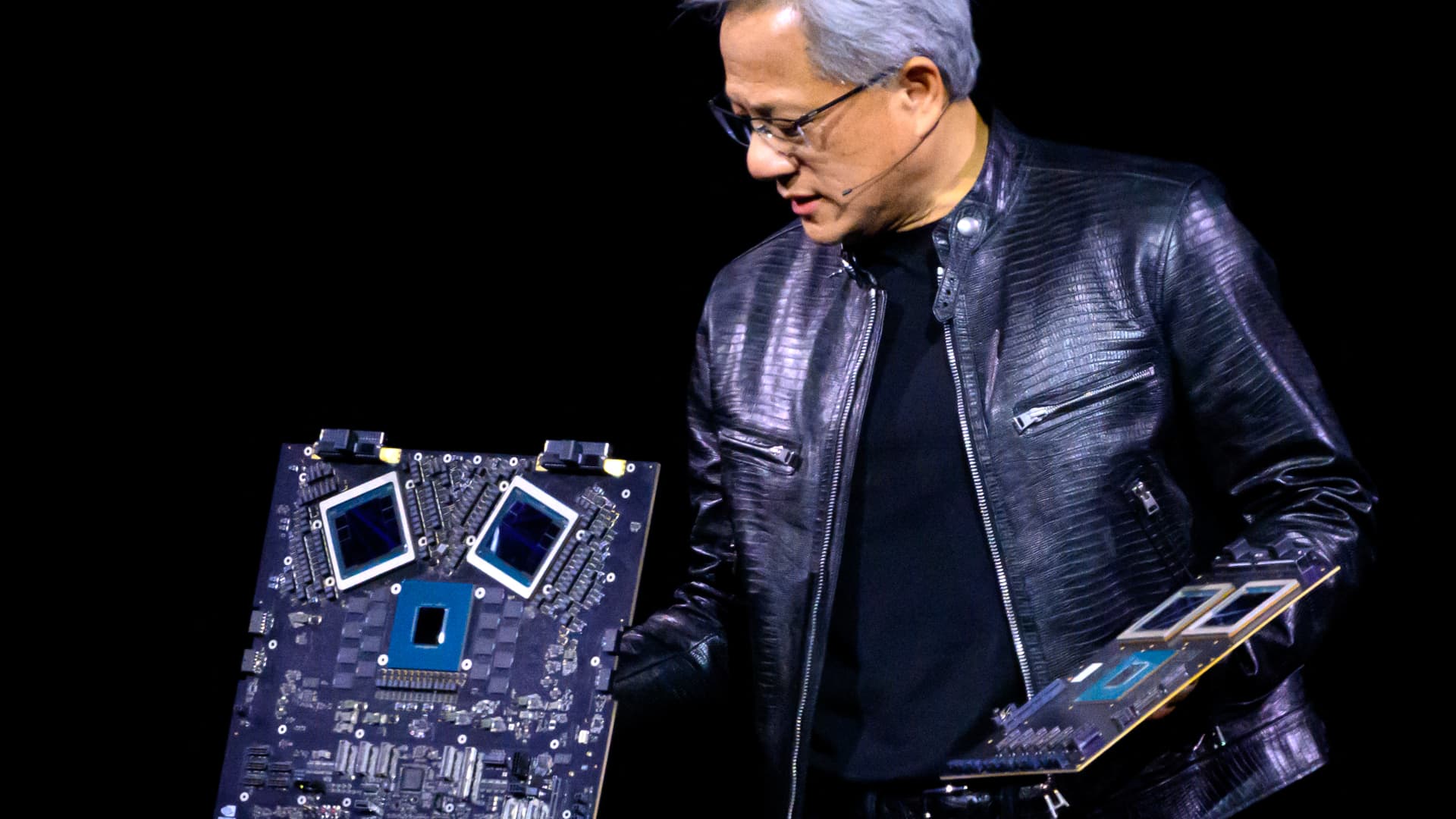

Federal Reserve Bank Chairman Jerome Powell testifies before the House Financial Services Committee in the Rayburn House Office Building on Capitol Hill on March 06, 2024 in Washington, DC.

Chip Somodevilla | Getty Images

The Federal Reserve has a lot to do at its meeting this week, but ultimately may not end up doing a whole lot in terms of changing the outlook for monetary policy.

In addition to releasing its rate decision after the meeting wraps up Wednesday, the central bank will update its economic projections as well as its unofficial forecast for the direction of interest rates over the next several years.

As expectations have swung sharply this year for where the Fed is headed, this week’s two-day session of the Federal Open Market Committee will draw careful scrutiny for any clues about the direction of interest rates.

Yet the general feeling is that policymakers will stick to their recent messaging, which has emphasized a patient, data-driven approach with no hurry to cut rates until there’s greater visibility on inflation.

“They’ll make it clear that they’re obviously not ready to cut rates. They need a few more data points to feel confident that inflation is heading back to target,” said Mark Zandi, chief economist at Moody’s Analytics. “I expect them to reaffirm three rate cuts this year, so that would suggest the first rate cut would be in June.”

Markets have had to adjust to the Fed’s approach on the fly, scaling back both the timing and frequency of expected cuts this year. Earlier this year, traders in the fed funds futures market were anticipating the rate-cutting campaign to kick off in March and continue until the FOMC had cut the equivalent of six or seven times in increments of quarter percentage points.

Now, the market has pushed out the timing until at least June, with only three cuts anticipated from the current target range of 5.25%-5.5% for the Fed’s benchmark overnight borrowing rate.

The swing in expectations will make how the central bank delivers its message this week all the more important. Here’s a quick look at what to expect:

The ‘dot plot’

Though the quarterly plot of individual members’ expectations is pretty arcane, this meeting likely will be all about the dots. Specifically, investors will look at how the 19 FOMC members, both voters and nonvoters, will indicate their expectations for rates through the end of the year and out to 2026 and beyond.

When the matrix was last updated in December, the dots pointed to three cuts in 2024, four in 2025, three more in 2026, and then two more at some point to take the long-range federal funds rate down to around 2.5%, which the Fed considers “neutral” — neither promoting nor restricting growth.

Doing the math, it would only take two FOMC members to get more hawkish to reduce the rate cuts this year to two. That, however, is not the general expectation.

“It only takes two individual dots moving higher to raise the 2024 median. Three dots are enough to push the long-run dot 25bp higher,” Citigroup economist Andrew Hollenhorst said in a client note. “But the combination of inconclusive activity data and slowing year-on-year core inflation should be just enough to keep dots in place and [Fed Chair Jerome] Powell still guiding that the committee is on track to gain ‘greater confidence’ to cut policy rates this year.”

The rate call for March

More immediately, the FOMC will conduct a largely academic vote on what to do with rates now.

Simply put, there is zero chance the committee votes to cut rates at this week. The statement from the last meeting all but ruled out an imminent move, and public statements from virtually every Fed speaker since then have also ruled out a decrease.

What this statement could indicate is perhaps a thawing in the outlook and an adjustment of the bar that the data will need to clear to justify future cuts.

“We still expect the Fed to cut interest rates in June, although we don’t expect officials to provide a strong steer either for or against” following the March meeting, wrote Paul Ashworth, chief North America economist at Capital Economics.

The economic outlook

Along with the “dot plot,” the Fed will release its quarterly update on the economy, specifically for gross domestic product, inflation and the unemployment rate. Collectively, the estimates are known as the Summary of Economic Projections, or SEP.

Again, there’s not a lot of expectations that the Fed will change its outlook from December, which reflected cuts for inflation and an upgrade for GDP. For this meeting, the focus will fall squarely on inflation and how that affects the expectations for rates.

“While inflation has hit a bump in the road, the activity data suggest the economy is not overheating,” Bank of America economist Michael Gapen wrote. “We think the Fed will still forecast three cuts this year, but it is a very close call.”

Most economists think the Fed could raise its GDP forecast again, though not dramatically, while possibly tweaking the inflation outlook a touch higher.

Big picture

On a broader scale, markets likely will be looking for the Fed to follow the recent plotline of fewer cuts this year — but still cuts. There also will be some anticipation over what policymakers say about its balance sheet reduction. Powell has indicated the issue will be discussed at this meeting, and some details could emerge of when and how the Fed will slow and ultimately halt the reduction in its bond holdings.

It won’t be just Wall Street watching, either.

Though not official policy, most central banks around the world take their cues from the Fed. When the U.S. central bank says it is moving cautiously because it fears inflation could spike again if it eases too soon, its global counterparts take notice.

With worries escalating over growth in some parts of the globe, central bankers also want some type of go signal. Higher interest rates tend to put upward pressure on currencies and raise prices for goods and services.

“The rest of the world is waiting for the Fed,” said Zandi, the Moody’s economist. “They would prefer not to have their currencies fall in value and put further upward pressure on inflation. So they would really, really like the Fed to start leading the way.”