The Office of General Counsel for the Small Business Administration sent a letter to lenders detailing several actions they must take by Dec. 5, 2025.

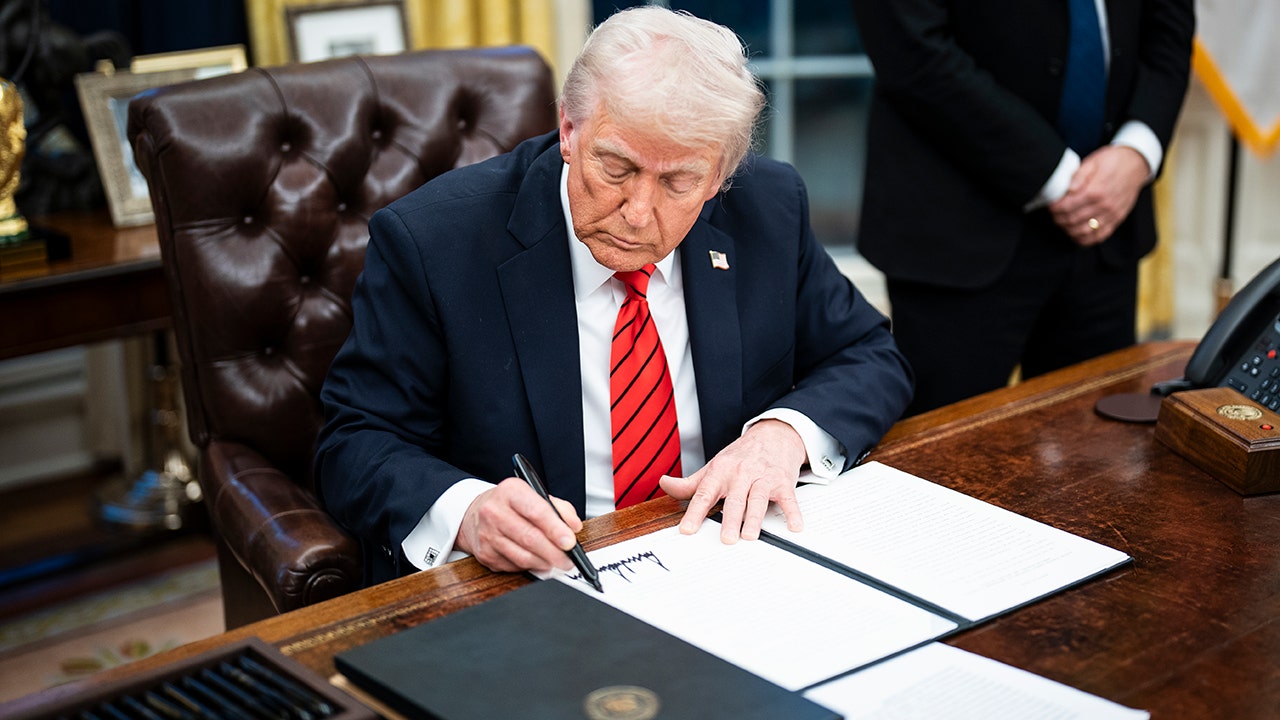

Under the executive order, federal banking regulators will be required to remove reputational risk and equivalent concepts from guidance and examination manuals, and the Small Business Association will require financial institutions to make efforts to reinstate clients and potential clients previously denied services due to an unlawful debanking policy.

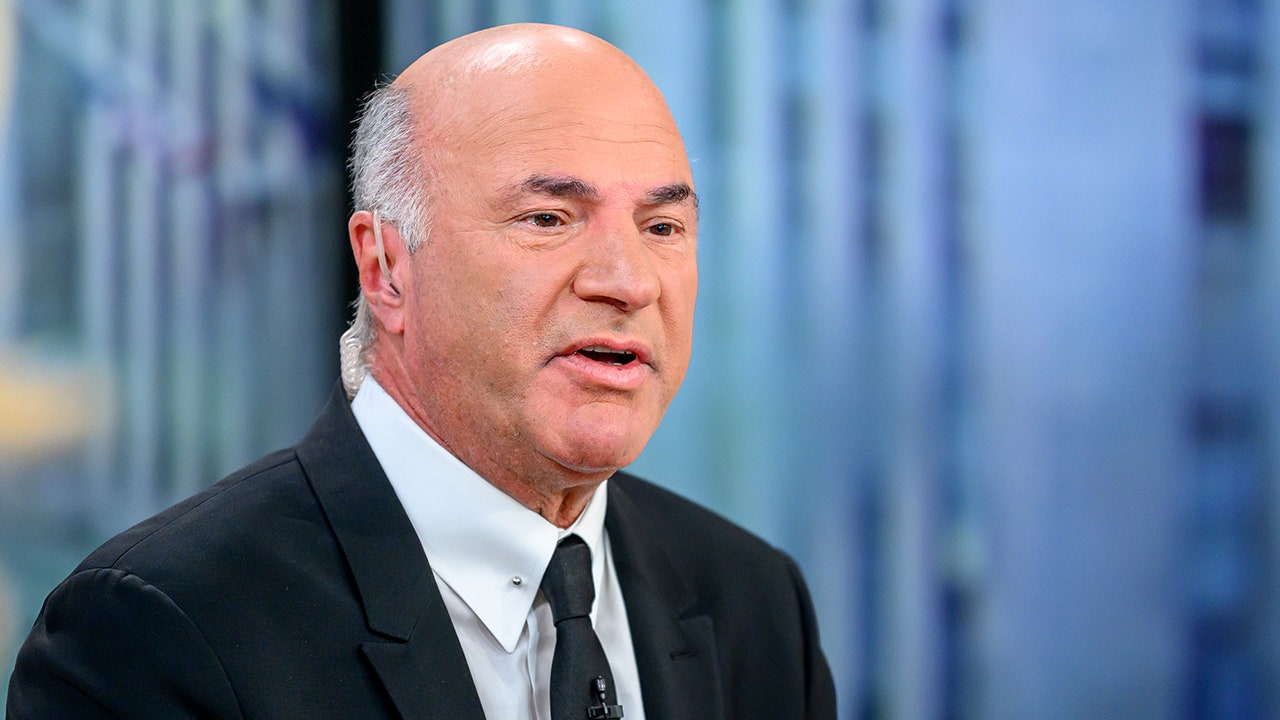

“The banks discriminated against me very badly,” President Donald Trump told CNBC’s “Squawk Box” this week. “They totally discriminate against – I think me maybe even more, but they discriminate against many conservatives.”

BANK EXECUTIVES BLOW THE WHISTLE ON HOW OBAMA, BIDEN ADMINS PRESSURED THEM TO DEBANK CONSERVATIVES

The SBA is requiring banking regulators, based on Trump’s executive order, to review supervisory and complaint data for instances of unlawful debanking based on religion and refers such cases to the office of the attorney general, and directs regulators to review financial institutions for past or current policies promoting politicized debanking, and issue fines, consent decrees and other remedial actions.

The SBA letter states, “There are myriad instances of religious and pro-life groups being debanked under the guise of ‘reputational risk.’ Even President Donald J. Trump and his family were debanked by numerous institutions that refused to accept his deposits or closed his accounts altogether.”

“This kind of discrimination against any American individual or entity is wholly unacceptable and will no longer be tolerated,” the letter says. “Pursuant to the Fair Banking Executive Order, the SBA is taking the action described in this letter to ensure no financial institution participating in the agency’s loan guarantee programs unfairly targets any current or future customers on the basis of political, religious, or ideological beliefs.”

RED STATE OFFICIAL RECOUNTS PERSONAL EXPERIENCE OF BEING ‘DEBANKED’ AND WHY IT ‘HAS TO BE STOPPED’

The letter outlines four specific actions that lending institutions must take to ensure they are complying with Trump’s order:

- By December 5, 2025, your institution must identify any past or current formal or informal policies or practices that require, encourage, or otherwise influence your institution to engage in politicized or unlawful debanking as specified by the Fair Banking Executive Order.

- By December 5, 2025, your institution must make reasonable efforts to identify and reinstate any previous clients of your institution or any subsidiaries denied service through a politicized or unlawful debanking action in violation of a statutory or regulatory requirement under section 7(a) of the Small Business Act (15 U.S.C. 636) or any requirement in a Standard Operating Procedures Manual or Policy Notice, and send notice of the reinstatement to the injured party;

- By December 5, 2025, your institution must identify all potential clients denied access to financial services provided by your institution or any subsidiaries through a politicized or unlawful debanking action in violation of a statutory or regulatory requirement under section 7(a) of the Small Business Act or any requirement in a Standard Operating Procedures Manual or Policy Notice, and provide notice to each otherwise qualified client advising of the denied access and the renewed option to engage in such services previously denied; and

- By December 5, 2025, your institution must identify all potential clients denied access to payment processing services provided by your institution or any subsidiaries through a politicized or unlawful debanking action in violation of a statutory or regulatory requirement under section 7(a) of the Small Business Act or any requirement in a Standard Operating Procedures Manual or Policy Notice, and provide notice to each victim advising of the denied access and the renewed option to engage in such services previously denied.

HERE’S WHAT CAN BE DONE ABOUT DEBANKING, THE UN-AMERICAN ABUSE OF POWER BY REGULATORS

The letter then states that the institutions have 30 days from Dec. 5 to provide the SBA with a report detailing how they addressed the compliance, requiring evidence within the report to prove compliance.

FOX Business’ Preston Mizell contributed to this report.