The deadly wildfires that hit Southern California this week destroyed a significant number of homes after some leading insurance companies pulled back on offering policies in the Golden State in recent years due to the rising risks of wildfires as well as a challenging regulatory environment.

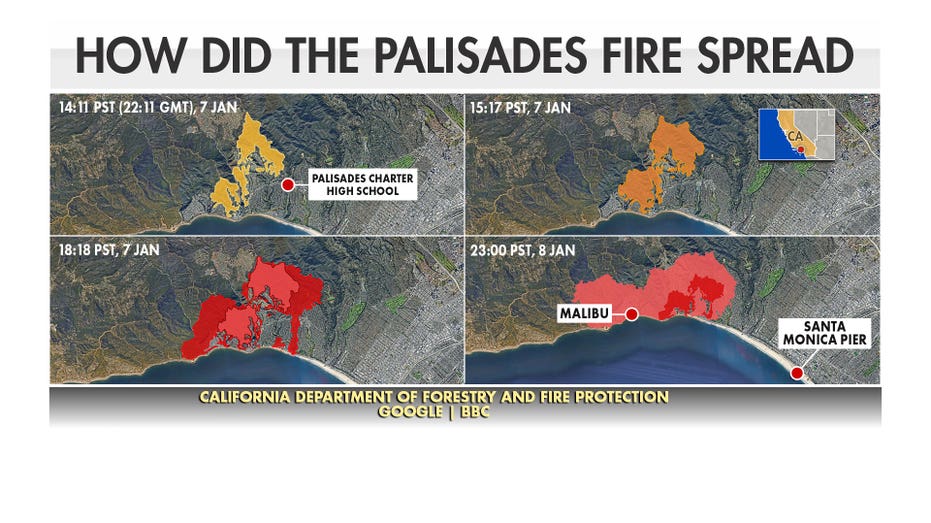

Several ongoing wildfires, including the Palisades Fire and Eaton Fire, have devastated communities in the Los Angeles area, including Pacific Palisades and Altadena. The fires have burned nearly 30,000 acres amid a Santa Ana wind event, with at least 130,000 people in the area under evacuation orders. At least five people have been killed in the blazes, and more than 1,000 buildings have been destroyed.

State Farm, the largest home insurance company in California, announced in March 2024 that it would discontinue coverage of 72,000 home and apartment policies in the summer. The company cited inflation, regulatory costs and increasing risk of catastrophes for its decision and had previously stopped accepting new applications in the state.

Several other leading insurers, including All State, Farmers and USAA, have also in recent years curbed new policy applications in California as part of an effort to limit their exposure to policies that carry what they see as undue risk given what the state’s regulators have allowed them to charge policyholders. Similar reasons of escalating risk, high repair costs and rising reinsurance premiums have been cited in those decisions.

CALIFORNIA WILDFIRES DEVASTATE LOS ANGELES COUNTY, KILLING 5 AND THREATENING THOUSANDS OF HOMES

This week’s wildfires brought new attention to the issue of insurers no longer taking on new policies or declining to renew previous policies in California communities at high risk of wildfires, as prominent entertainment industry figures called out the moves in the wake of the disaster.

James Woods, an actor who owns a house in the Southern California area scorched by the Palisades Fire, wrote on X that “one of the major insurances [sic] companies canceled all the policies in our neighborhood about four months ago.”

Actor Rob Schneider criticized State Farm in a post on X and wrote, “Screw you and all your phoney [sic] commercials!! You are a pile of crap for canceling insurance policies of Californians! I will never use State Farm insurance ever again!”

A State Farm spokesperson said in a statement to FOX Business, “Our number one priority right now is the safety of our customers, agents and employees impacted by the fires and assisting our customers in the midst of this tragedy.”

STATE FARM CUTS 72,000 CALIFORNIA HOME INSURANCE POLICIES: ‘DECISION WAS NOT MADE LIGHTLY’

The state of California’s home insurance market has struggled in part due to regulatory constraints on what companies can charge policyholders in premiums, as well as mounting exposure due to wildfires and other severe weather events that have caused payouts to climb and strained the reinsurance market.

California voters approved Proposition 103 in 1988, which was intended to protect insurance policyholders from unfair rate hikes by requiring that insurers obtain approval from the California Department of Insurance for any increases beyond 7%. The law also caps rate hikes and spreads any increases out over a period of three years.

CALIFORNIA WILDFIRES PROMPT SCRUTINY OF FEDERAL, STATE RULES HAMPERING MITIGATION EFFORTS

While insurers can and do receive approvals for larger increases — State Farm secured a 20% increase in home and auto premiums in January 2024 and subsequently requested a 30% increase for home policies last summer — the process can be time-consuming and the size of rate hikes approved by the regulator may not be sufficient for insurers to continue offering policies while preserving their financial stability.

By curbing insurers’ ability to raise rates to account for increasing risk, it keeps insurance plans artificially low for consumers. That means insurance companies face a decision between keeping that excess financial exposure on their books or taking steps to limit their exposure or leaving the market.

The state of California offers what’s called the FAIR Plan as an insurer of last resort for consumers who were unable to secure a plan on the private market. However, the policies are still expensive and insurers are raising concerns about the sustainability of the FAIR Plan’s growth.

The FAIR Plan’s exposure increased by $174 billion, or more than 61%, from September 2023 to September 2024, when its residential exposure reached $458 billion. The number of dwelling policies in force under the FAIR Plan rose from 320,581 to 451,799 in that period, while they have increased by 248,902, or 123%, since September 2020.

“The FAIR Plan continues to grow in size as consumers find themselves without coverage. As a result, we have doubled in size in the last three years,” FAIR Plan President Victoria Roach said at a hearing in March. “As the numbers climb, our financial stability comes more into question.”