As conservatives continue to deal with the dangers of being “debanked” for their political beliefs, conservative finance group “Coign” is launching a new savings alternative they say will both enable customers to meet their financial goals while also helping with “rebuilding America.”

A financial technology (fintech) company founded with the express purpose of catering to a conservative clientele, Coign regularly donates to organizations like the Heritage Foundation, Turning Point USA and veterans’ groups instead of groups focused on DEI and other liberal causes often supported by banks and financial institutions.

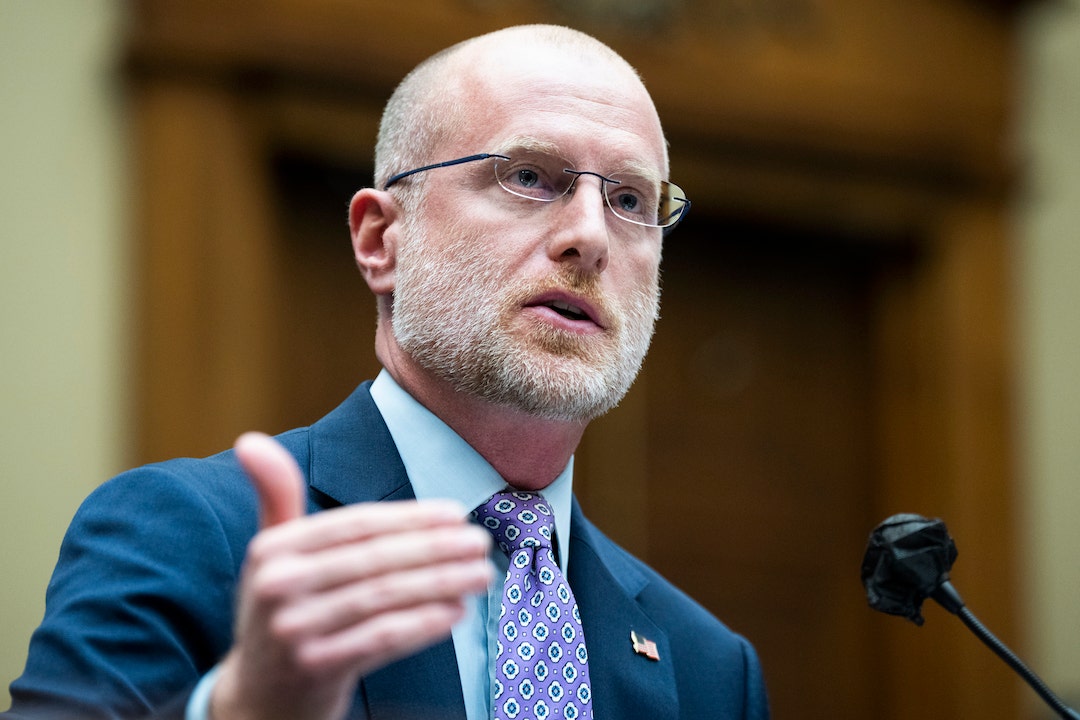

In an interview with FOX Business, Coign CEO Rob Collins said last year alone, the company “gave more money to conservative charities than the top five credit card companies combined.”

“Conservatives have been pushed out of the public square. They’ve been pushed out of the boardroom. They’ve pushed out of the marketing and cultural decisions. And that’s not by accident, that was on purpose,” he said. “But with Coign, we’re bringing together tens of thousands, hundreds of thousands of conservatives that will then unite their commerce and give us back our voice.”

IS DEI DYING? HERE’S THE LIST OF COMPANIES THAT HAVE ROLLED BACK THE ‘WOKE’ POLICIES

Now, the company is partnering with Illinois-based Constitution Bank to launch an FDIC-insured high-yield savings account that Collins said focuses on not only delivering a quality investment opportunity but also “solving America’s problems smartly and with the right values.”

The Coign high-yield savings account will be available toward the end of the year, according to Collins.

Though conservatives are often disregarded or frowned upon by the financial industry, Collins believes they make up a powerful underserved market.

“We as a conservative movement, we’re the largest, safest and wealthiest submarket in America; 120 million plus Americans identify as conservatives. And they have the longest tenure in their home, their marriage, their job, their car, you name it,” he explained.

TIM SCOTT INTRODUCES SENATE BILL TO ADDRESS DEBANKING OVER ‘REPUTATIONAL RISK’

“So, there’s this an incredibly huge block of people who watch the advertisements on the Super Bowl weekend or just being served to them through their internet provider, and they scratch their head and say, ‘What’s in this for me? These ads don’t speak to me. These corporations don’t speak to me; they seem to be speaking and supporting things that I don’t believe in.'”

“So, we’re really the first financial fintech company that’s going right to consumers and saying, ‘Hey, there’s an alternative,'” he went on. “It’s built by conservatives, for conservatives… So, whether they’re at the Reagan library or buying something for the kids that supports causes that don’t align with their values, they know in some way they’re still helping out, still giving back and still rebuilding this country.”

Though still a new company, Collins believes “this is just the start” of what could be a type of parallel economy of financial products that fit conservatives’ values and needs.

BIG BANK CEOS MEET WITH SENATORS OVER DEBANKING CLAIMS

Commenting on the new partnership, Jason Plummer, chairman of the board for Constitution Bank, said in a statement sent to FOX Business that “this collaboration is a win for both Constitution Bank and Coign.”

“By combining our banking capabilities with Coign’s huge community, we’re delivering a compelling product that creates value for savers and drives growth for both institutions,” said Plummer.