Trump Tax Cuts 2.0 can’t wait, and that’s the subject of the riff. During the years of President Trump’s first term, real average weekly wages — also known as take-home pay — rose over 9%.

During the Biden years, take-home pay plunged 3.6% for his entire term up until now.

One more stat: Median household incomes during the Trump years rose $7,700 pre-COVID, adjusted for inflation. During Joe Biden’s term, median incomes rose only $1,000. Those two numbers, take-home pay and median income, have a lot to do with Mr. Trump’s landslide election victory.

These were the kitchen-table issues for Mr. Trump’s working-class majority that spanned all races and cut so heavily into the Democrats’ former coalition.

The economy ranked first in every poll. When working folks are losing money and they can’t afford gasoline, groceries, electricity, new cars or new homes — color plays no role. It’s about the economy, and more than enough people remember how good they had it during the Trump years and how poorly they had it during the Biden-Harris years.

BIDEN PARDONS SON HUNTER BIDEN AHEAD OF EXIT FROM OVAL OFFICE

Here’s my point: The sooner President-elect Trump can restore the blue-collar boom, the stronger his political position will be in Congress and all around the country. That is why I’m concerned that the new administration may not start their legislative agenda with tax cuts.

We are hearing that there will be two reconciliation bills. The first tackling energy, defense and the border. The second would reauthorize expiring tax cuts later in the year. I don’t think tax cuts should wait, just as I don’t think Mr. Trump’s working-class coalition thinks tax cuts should wait. They want better take-home pay and lower inflation.

I’m all in favor of whatever it takes to produce 3 million more barrels of oil a day and bring down gasoline to $2 a gallon.

I’m totally in favor of building the wall in order to close the border, and if we’re going to shift from Biden’s appeasement to a Trumpian policy of peace through strength, we will need a stronger and more efficient Pentagon, but leaving tax cuts in the dust for some later date does not strike me as a good idea, in economic or political terms.

Why not one large-scale reconciliation bill? Which, until recently, was being promoted by House Majority Leader Steve Scalise and others. Push the boundaries of fiscal policy to include all of the previously discussed areas.

Remember Treasury Secretary designee Scott Bessent’s 3-3-3 formula? Three percent or better growth. Reduce the deficit to 3% or less of GDP and add 3 million more barrels a day. All good.

Tax cuts will help enormously to get us above 3% growth and reignite the blue-collar boom, and people should be listening to Sen. Mike Crapo, who’s expected to lead the Senate Finance Committee next year, who said “the cost of legislation should be measured against current policy, which assumes the popular Trump tax cuts will be extended forever.”

Mike Crapo has noted on this show that, in terms of scoring protocols by the Congressional Budget Office, if you let spending go on forever, thereby increasing every year, nobody scores that as a higher deficit, but, for some reason, if you let tax cuts go on forever, they want to score that as a huge deficit increase — with a static score, as a $4 trillion hike.

That’s nonsense. If continuing spending is current policy, continuing tax cuts should be current policy. Here’s what Sen. Crapo told me a couple of weeks ago:

SEN. MIKE CRAPO: And let me tell you another interesting thing, Larry: Under the spending protocols that we use, and the scoring protocols, extending current spending does not score as a deficit, but extending current tax [cuts] scores as a deficit.

By the way, those same Trump Tax Cuts 1.0 from the 2017 Tax Cuts & Jobs Act have yielded an enormous revenue windfall.

Economist Larry Lindsey in a report last summer noted that the corporate income tax cut alone has produced over 30% higher revenues than originally predicted by CBO in 2016, the year before the Trump tax cuts were passed, and the top 1% of taxpayers continue to pay more and more of the total share, now coming to nearly 46%, which is a good reason to cut those individual tax rates as much as possible.

Plus, the importance of the 1099 small business tax deduction, and remember small business folks with their LLCs pay the individual income tax rate, and Steve Forbes is right — reducing the capital gains tax will not only power economic investment and productivity and growth, it will also generate a massive revenue windfall just as it has in the past.

The sooner Trump 2.0 Tax Cuts can get moving in Congress, the happier those working-class Trump voters will be, and the faster the blue-collar boom will reignite. That’s the riff.

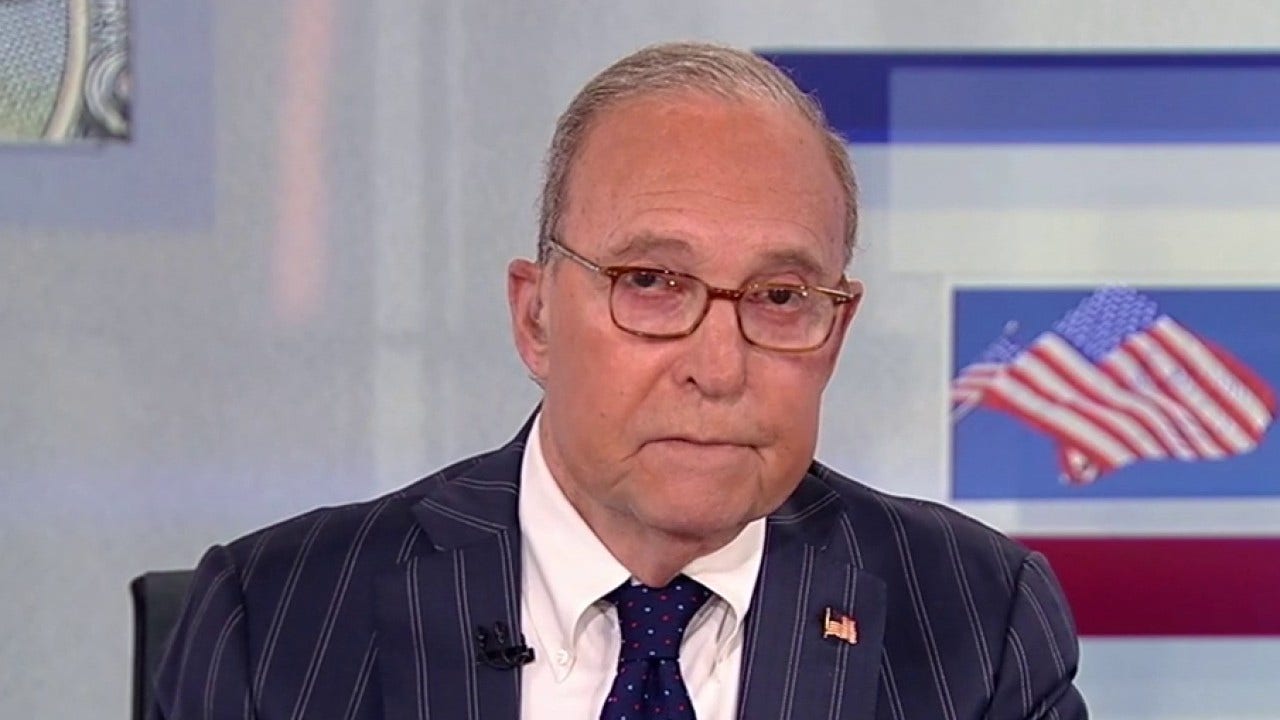

This article is adapted from Larry Kudlow’s opening commentary on the Dec. 3, 2024, edition of “Kudlow.”