For years, studies have projected a wave of small businesses will change hands in the U.S. as a “silver tsunami” of aging baby boomer entrepreneurs retire.

But the pandemic, high inflation, rate hikes and other economic disruptions and uncertainty have caused jitters for aspiring buyers and sellers alike. Now, evidence shows the great boomer business sell-off is underway, and it is far from over.

A study from Forrester last year showed that younger generations, those born in 1980 or later, now make up the majority (64%) of small business buyers globally.

Here in the U.S., recent surveys from BizBuySell found 66% of business brokers think “an increasing number” of buyers will enter the market in 2024, and 75% expect more owners to sell their business in 2024 than in 2023.

SURGE IN US SMALL BUSINESSES STARTED AS SIDE HUSTLES

BizBuySell’s latest insight report found transactions were up 10% year over year in the first quarter, and the analysis expects deals to pick up the pace through 2024, with more sellers planning to offer seller-financing.

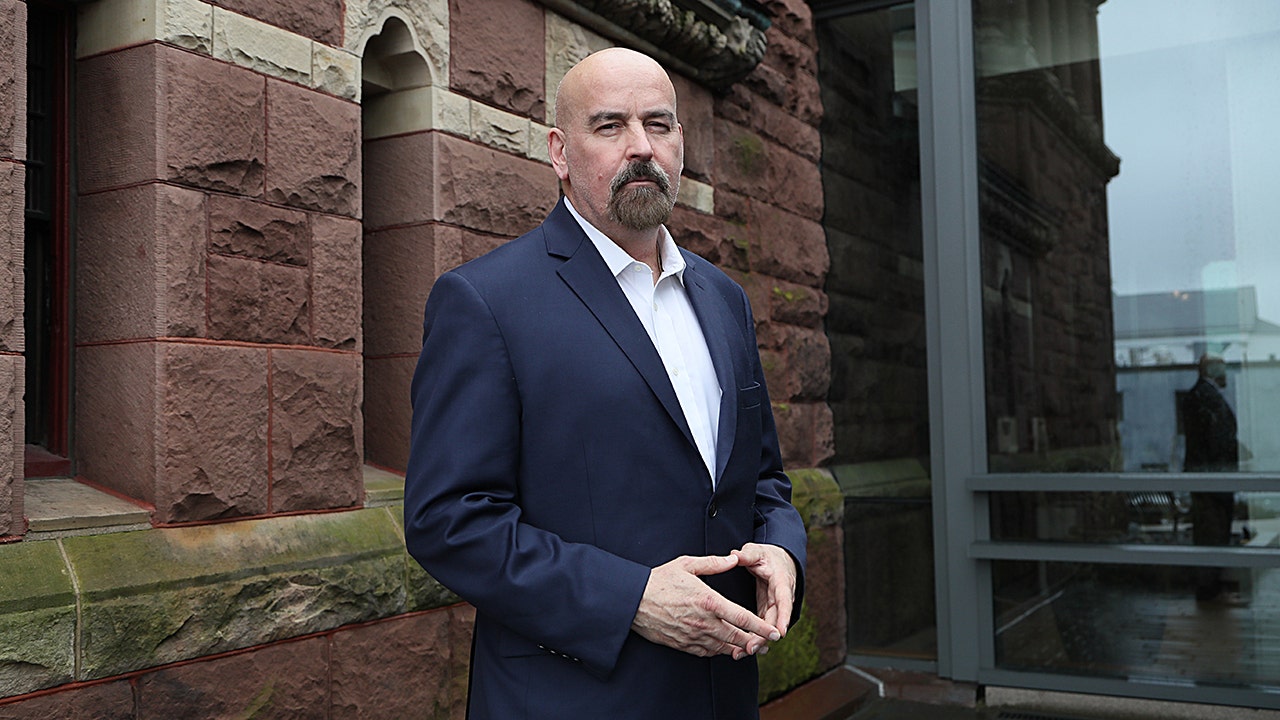

Codie Sanchez is the founder and CEO of Contrarian Thinking, a media, investing and education company that teaches aspiring entrepreneurs how to acquire “boring” cash-flowing businesses, like laundromats. She told FOX Business in an interview that the “silver tsunami” of boomers selling their businesses “is not even close to cresting.”

“We see something like 10 to 11 million small businesses for sale in the U.S. in any three-year moving period,” Sanchez said. “We see one in 10 baby boomers who own a business open to just closing down their business overall, and about six out of 10 – so 60% – open to seller-financing … using the profits from their business to give it to the next generation.”

THE ‘MAGIC NUMBER’ TO RETIRE COMFORTABLY HITS NEW ALL-TIME HIGH

Sanchez said many business owners over 65 are thinking about handing it down to someone else upon retirement, like their own children or an apprentice. Others are considering shutting their businesses down altogether, and these scenarios present opportunities for aspiring entrepreneurs.

“We as young people can start going directly to small business owners, who might be our neighbors or parents, friends, people we work for and inquire about purchasing the business,” she said, adding, “There’s nothing better than when somebody young and hungry wants to take over your legacy and move it forward.”

Sanchez, who owns a portfolio of companies, recommends vetting any business first, to make sure it is a good fit. Then, once a prospective buyer finds the perfect match, they can go through the process of figuring out how to work out a deal.

“I don’t mean to make this sound overly easy,” Sanchez said. “It’s not easy, but I think it’s more simple and common than people think, and that is a huge hope for young people.”