Members of Congress pressed the CEO of the nation’s largest credit union for answers about racial disparities in its mortgage lending during a Capitol Hill meeting Thursday but said they left unsatisfied with her responses.

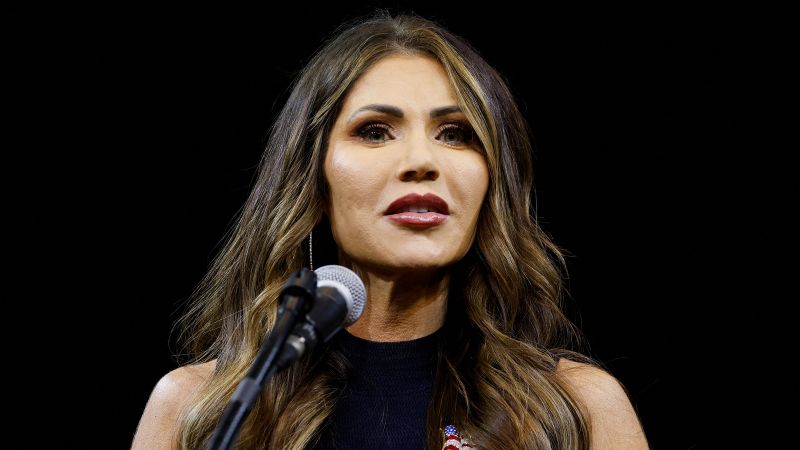

Mary McDuffie, the CEO of Navy Federal Credit Union, met with three members of the Congressional Black Caucus who have demanded answers in the wake of CNN’s reporting on racial disparities in the lender’s mortgage approvals.

It’s the latest example of congressional scrutiny for Navy Federal, which has more than 13 million members and lends to military servicemembers, defense personnel, veterans and their families.

“We’re trying to achieve the goal of closing the racial wealth gap in America,” said Rep. Steven Horsford, a Nevada Democrat, after meeting with McDuffie. “You cannot do that with practices like this that deny equal opportunity to homeownership.”

A CNN investigation published in December found that Navy Federal approved more than 75% of the White borrowers who applied for a new conventional home purchase mortgage in 2022 while approving less than 50% of Black borrowers who applied for the same type of loan, according to the most recent federal data available.

The nearly 29-percentage-point gap in Navy Federal’s approval rates was the widest of any of the 50 lenders that originated the most mortgage loans in 2022. The disparity remained even after accounting for variables such as applicants’ income, debt-to-income ratio and property value, CNN’s review found.

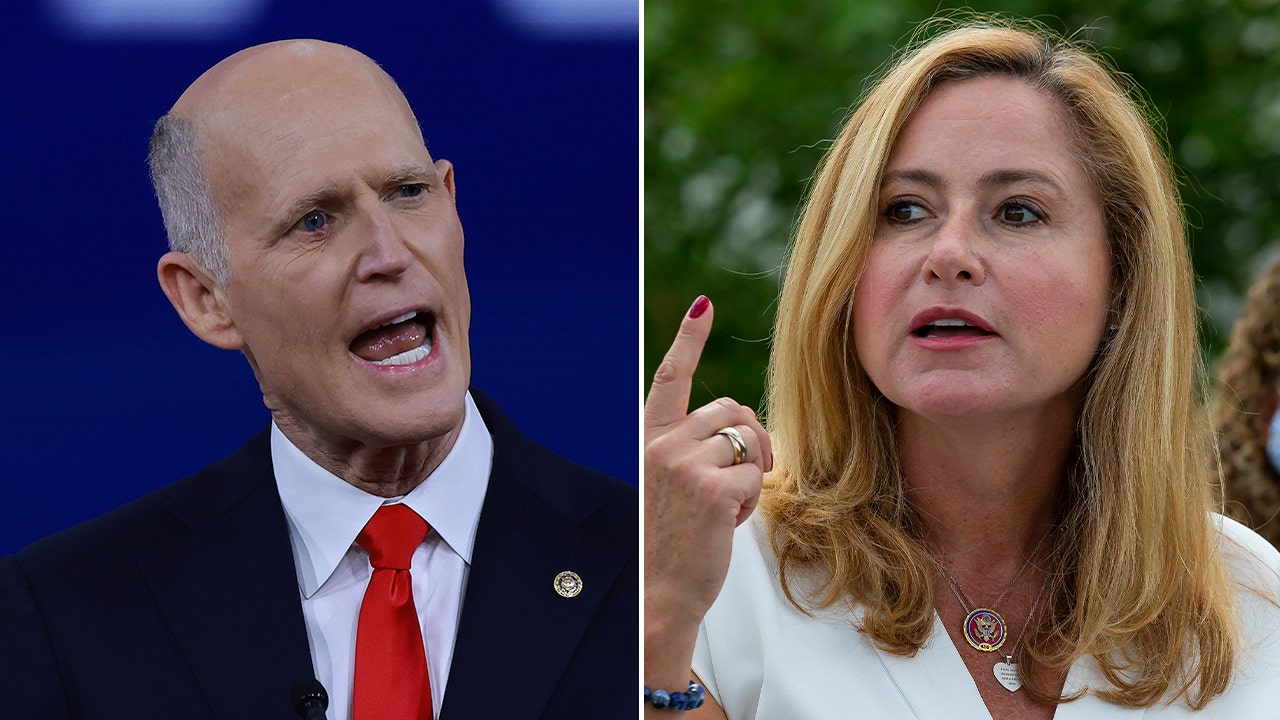

McDuffie met for about an hour Thursday with Horsford, the chair of the Congressional Black Caucus; Rep. Emanuel Cleaver of Missouri, the ranking Democrat on the House Subcommittee on Housing and Insurance; and Rep. Sydney Kamlager-Dove of California.

McDuffie declined to answer CNN’s questions as she entered and exited the closed-door meeting.

Cleaver told CNN after the meeting that McDuffie and other Navy Federal representatives “could not provide an answer” explaining the racial disparities in mortgage approvals, and that he hoped to hear more from them in the future. “We’re expecting to have another meeting with them, we’re expecting to get facts this time,” he said.

A Navy Federal spokesperson said in a statement that the credit union is “committed to engaging with policymakers on this important issue” and “we work daily to help expand economic opportunity and access to credit for our diverse community of members.”

In December, days after CNN’s story was published, Navy Federal hired a civil rights lawyer to review its mortgage practices and “make recommendations to drive further access to home ownership.”

Horsford said that the members “asked very specific questions about the timeline of that review,” and found the responses from Navy Federal “inadequate.”

“Time is of the essence, because every single day that they don’t change or update their protocols is a servicemember, and particularly a Black or Latino servicemember, who is facing denials,” he said.

Navy Federal has previously argued that CNN’s analysis is incomplete because it did not include applicants’ credit scores or information about their available cash deposits or relationship history with the lender – none of which is publicly available in the federal data. The credit union declined to provide CNN any additional data that would make it possible to analyze those factors.

Navy Federal has also noted that a higher percentage of its mortgage loans go to Black borrowers than most other large lenders. But Horsford said Thursday that that excuse didn’t address “the issue of denials.”

“More than 40% of our servicemembers, active duty, are people of color,” he said. “So yeah, they are one of the leading lenders and mortgage lenders for Black home loans – because they have a higher percentage of servicemembers who are their membership. It should be higher.”

Several Democrats on the House Financial Services Committee, including Cleaver and ranking member Rep. Maxine Waters, a California Democrat, wrote a letter last week asking the committee’s Republican chair to hold a hearing on the racial disparities in Navy Federal’s mortgage lending.

And ten Democratic senators have separately asked federal regulators to examine Navy Federal’s mortgage practices, citing both CNN and a separate analysis of public mortgage data by Senate banking committee staff that also found racial disparities in its lending.

Navy Federal is also facing a federal class-action lawsuit from mortgage applicants who cite CNN’s reporting and allege that the credit union discriminated against them. A judge approved a motion to consolidate three separate lawsuits against the credit union into a single case last month.