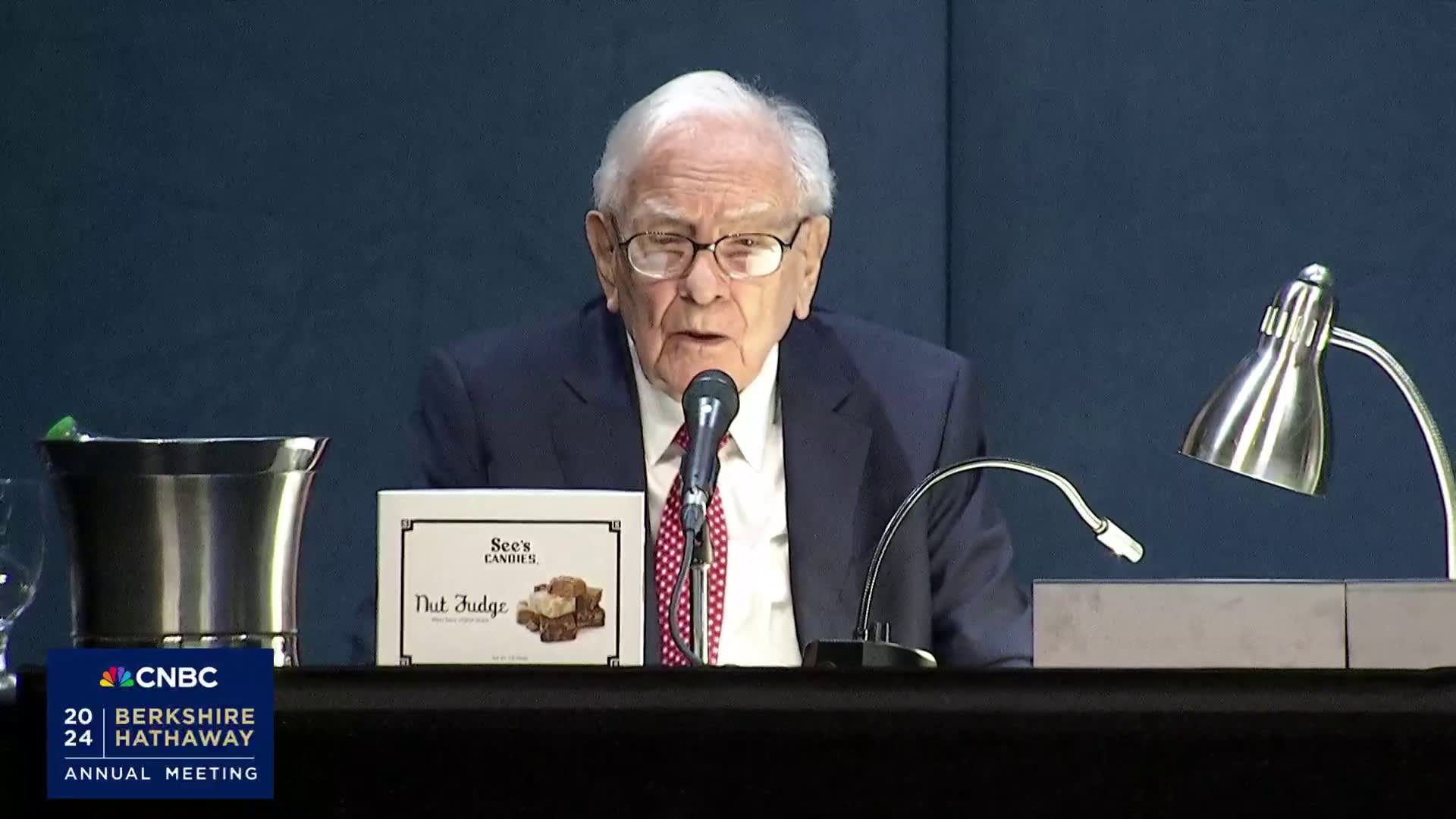

Warren Buffett is the first to admit he doesn’t know much about artificial intelligence. That’s in keeping with his long-time philosophy of steering clear of technology that is beyond his grasp. His massive stake in Apple, for example, his largest stock holding even if it’s been reduced, came about more as an epiphany related to its consumer success than as a technology bet, he said over the weekend at the Berkshire Hathaway annual meeting. But at the closely watched event in Omaha this year, the billionaire investor and Berkshire CEO and chairman couldn’t avoid AI as a topic on the minds of shareholders.

Buffett fielded several questions about artificial intelligence. Calling AI profound, Buffet said that the technology is like a “genie” — once it gets let out of the bottle, it could have disastrous effects. The worst fears he sees — massive scamming ability enabled by AI to the threat of a breakthrough science equivalent to nuclear weapons in unintended consequences and risk to humanity. And there is at least one question, Buffett said, that no one can answer when it comes to AI’s impact on the world which may change the lives of every individual on a daily basis. It’s a question, he said, that has riddled the best economists for a century.

“It can create an enormous amount of leisure time,” Buffett said. “Now what the world does with leisure time is another question. … I know an awful lot of people think when they go to work at first what they want is leisure time – and what I like is actually having more problems to solve,” said Buffett, who is famous for having said he has “tap danced” to work in his Omaha office for decades.

Buffett pointed to the example of John Maynard Keynes, one of the most important economic thinkers of the modern era, who correctly predicted output per capita would grow at an exponential rate, but failed to predict what humans would do with increased productivity. Keynes is generally regarded as the father of macroeconomics, known best for his support of government intervention through social and job programs in order to stabilize economics during economic downturns including the Great Depression, and books including “The General Theory of Employment, Interest, and Money,” which Buffett recommended adding to a reading list.

Productivity has been booming over the past several quarters. According to BLS data, after a massive productivity spike during Covid, there was a protracted slump, and it’s only over the past four quarters that the data has turned around, up roughly 3% year over year. This rebound has led to questions from corporate executives about factors that could be at play, from AI to return-to-office mandates. But most say that it’s still too early in the technology’s implementation to make any connection, drawing a distinction between AI that has been deployed for years already and where gains can be tracked, versus the generative AI that everyone is talking about today, and that will take some time to show up in the data.

Economic researchers also caution against reading too much into any short-term productivity boost, as quarterly government data is often subject to significant revision and it can takes years to be able to identify a major change in the productivity trend line.

AI will ultimately be a major labor productivity driver, even if it’s not there yet. IBM vice chair and former head of the National Economic Council Gary Cohn said on CNBC last week that AI adoption is quickly happening, and the productivity gains are also happening, albeit slowly. “Every company is looking at AI and deciding where it will help them,” he said during a recent interview on CNBC’s “Money Movers.”

“This is an evolution; we are going to evolve into this in the productivity game, and it is going to feed through the economy slowly,” Cohn said. But he added, “I don’t think we’ve seen the real productivity boost from AI.”

Most companies are still in the stage of setting budgets for AI and overarching strategy for how it can help both customers and employees, and trying to get into implementation mode.

MongoDB CEO Dev Ittycheria, whose company released a suite of tools last week to help companies “overwhelmed by AI,” recently told CNBC that executives have reached the point of asking when the AI value and return will accrue to them. The market is passing through the phase of the value accruing only at the bottom layer, such as Nvidia and ChatGPT/OpenAI, and it is now critical for companies to prepare for the applications built on top of that infrastructure.

“Clearly, there is a trend where we go to ‘agentic’ workflows, agents take actions on behalf of the end user autonomously. It’s a little ways out, but people do need to build apps and enrich customer experience and drive more cost out of the business and find new ways to drive growth.”

Productivity booms and technology

Productivity booms are rare and tend to be once-in-a-generation events — the last was in the mid to late 1990s leading up to the dotcom crash — a period of significant economic growth notably not driven by creation of new jobs.

The problem of technological advances decreasing the amount of available jobs is an ongoing concern, and there have been countless surveys published since the release of ChatGPT in late 2022 covering job losses, or in the jargon often used to reflect the uncertainty over exact impact, jobs with “AI exposure.”

Companies like to say that AI won’t replace jobs, but will allow human workers to focus on higher-value skills and tasks while giving over to the machines the rote work that humans don’t like to do anyway. But about 37% of business leaders surveyed by Resume Builder said technology replaced workers in 2023, with 44% saying more layoffs would happen this year due to advancements in AI. However, historically technological advancements — such as the increase of industrialization — haven’t proven to be the career killers that experts warn about.

Due to the potential lack of job opportunities with the growth of AI, some experts, as well as billionaires and politicians, have expressed the need for a universal basic income, or UBI, in order to supplement lower or no salaries and keep the economy afloat. The tech icons discussing the idea include Elon Musk, Mark Zuckerberg and Sam Altman.

Still, there is reason to be skeptical about the exact relationship between technology and jobs.

In the late 1980s words of the godfather of productivity research, Nobel Prize-winning economist Robert Solow, “You can see the computer age everywhere but in the productivity statistics.”

That was known as Solow’s productivity paradox, and the late 90s boom would challenge it. But later research would show there was in fact a murky relationship between the dotcom era and productivity gains. A co-author of that work at McKinsey told the Harvard Business Review that the embrace of Solow’s view in relation to the 90s tech boom was “oversimplified,” and so was the view that came after it, that the internet drove the productivity boom.

With these concerns, and unanswerable questions, in mind, Buffett said that human labor-intensive companies like Berkshire Hathaway need to consider a balance between how technology can help them become more efficient without endangering humans.

“I don’t know how you make sure that that’s what happens any more than I know how to be sure that when you use two atomic bombs in World War II that you knew that you hadn’t created something that could destroy the world later on,” Buffett said.